One of the most distictive parts of development, investment, and transaction in lodging properties is the working capital. Working capital refers to cash and cash equivalents required to manage the time difference between inflow and outflow of cash, to maintain solvency. Here, cash inflow means revenues, and cash outflows means expenses. Working capital is usually calculated by subtracting current liabilities, including accounts payable, from current assets, including accounts receivable.

It takes some time for the generated revenues to be encashed. For example, it happens every day when a consumer purchases goods or services by paying with a credit card, but the accrued revenues are usually settled once a month and deposited into the operating account. The generated revenues not yet enchased into the operating account are called accounts receivable.

By the way, the fact that revenues are generated also means that there expense s are occured to produce goods or services for consumers. The expenses may have to be paid before the generated revenues are encashed, or later, subject to arragements. If an expense hase to be paid before the revenues are encashed, the operator will pay with cash and cash equivalents. If an expense has occured but not yet been paid in cash, it will be recorded as an account payable.

1. Working Capital of Lodging Properties in Korea

In the case of general real estates, the rent, which is revenues, is paid once a month. Relevant expenses are paid once a month as well. In other words, the timing for cash inflow can match the timing for cash outflow. Even if there is a time difference between inflows and outflows, the security deposit can be used as the working capital to manage the difference.

On the other hand, in the case of lodging properties, revenues are generated on a daily or hourly basis, and expenses are paid on various cycles. This means that managing the time difference between cash inflows and outflows is much more difficult for lodging properties. In addition, the lease to third-party operators is not a prevalent practice in lodging industry, and the working capital cannot be sourced from security deposits.

The nature of lodging business is a daily lease of rooms without security deposit. Therefore, its revenues are more volatile than other properties rented on an annual basis. In addition, the rent is paid regardless of whether they are actually used or not, while all or part of the revenues generated in a lodging property should be refunded if not used. In other words, the volatility of cash inflows is bound to be huge.

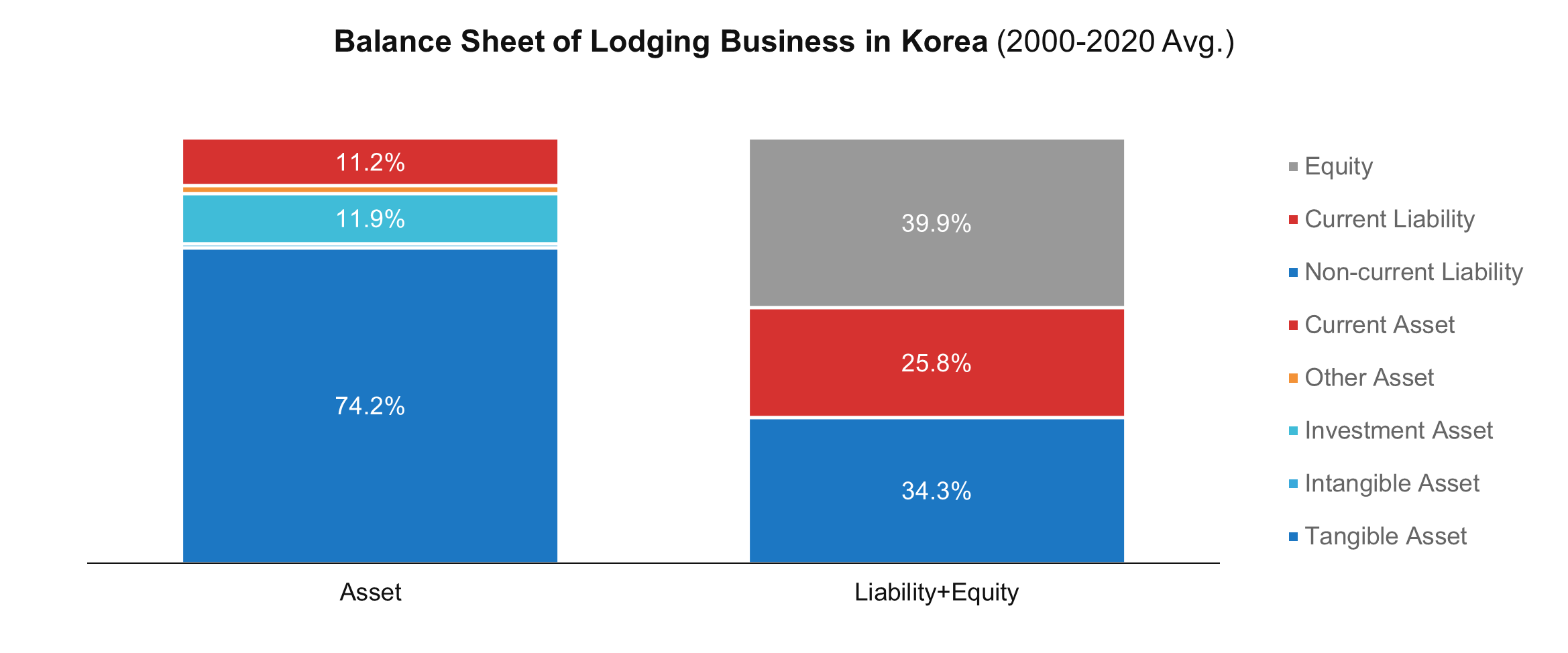

However, the non-current assets accounts for majority of assets in loding industry, just like other real estates, while the lodging business is more labor-intensive than any other real estates. Therefore, the lodging business carries higher fixed expense basis than other real estates. If a part of the capital is sourced as a loan, the interest payment is added on top of already high fixed expenses. As a result, the burden on working capital in the lodging industry is very high compared to other real estates due to the unbalance between elastic cash inflows and inelastic cash outflows.

There are always exceptions, but in general, current liabilities are always larger than current assets. In other words, working capital is negative in most cases, and the operator should carry cash and cash equivalents as much as the working capital, or or source immediately, in order to maintain solvency.

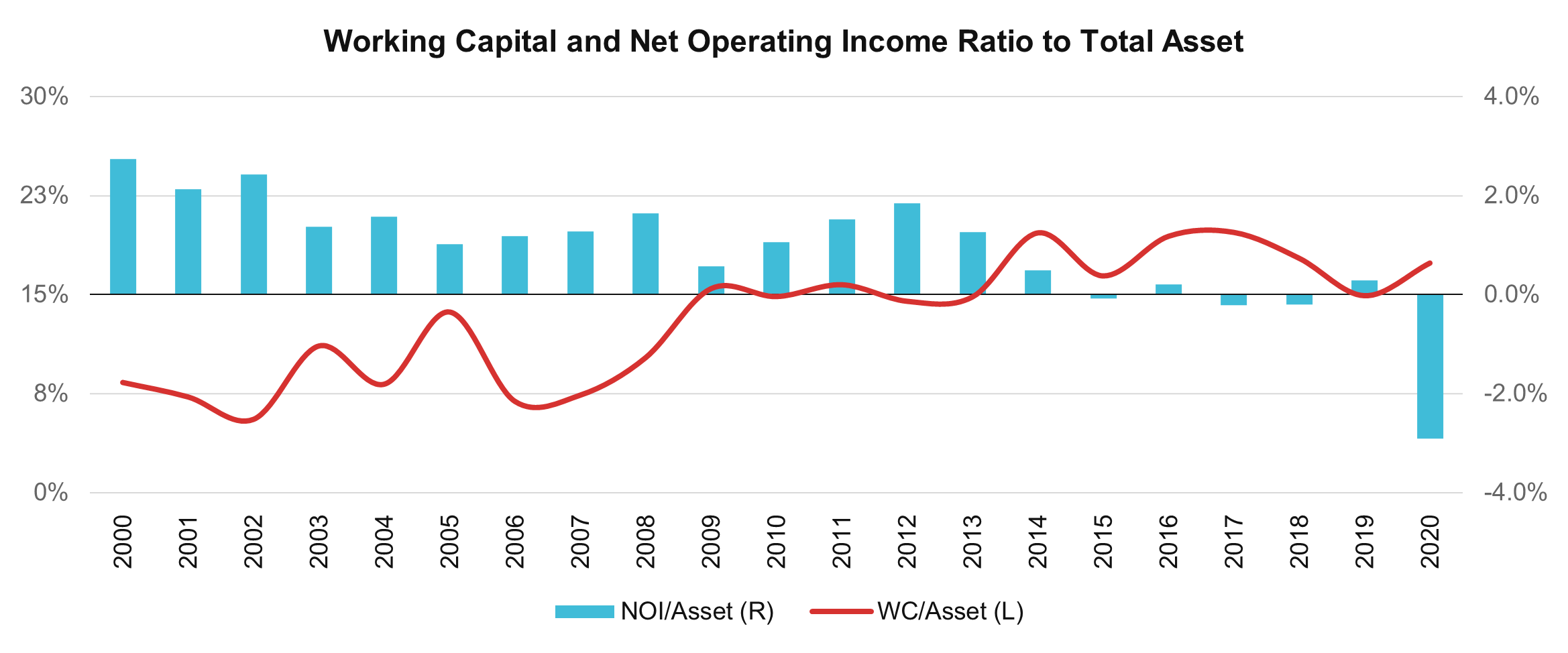

According to the Enterprise Analysis Report by Bank of Korea, the absolute value of working capital in the Korean lodging industry from 2000 to 2020 was 14.6% of total assets, on average, with the standard deviation was 4.6%. The volatility of the working capital to total assets ratio was not significant. When operating profit increased, the burden decreased, and vice versa. The burden troughed in 2002, when the Korea-Japan World Cup was held, with 5.6% of total assets. The burden peaked in 2014, when new hotel supply began to surge, with 19.7% of total assets.

2. Importance of Optimal Working Capital

Working capital is greatly influenced by the volatility of revenues and the elasticity of expenses. Surplus cash and cash equivalents are necessary unless the volatility of revenues cannot be accurately predicted, which is the case for lodging industry due to high volatility in revenues and a high proportion of fixed expenses. The easiest way to stock up on the surplus is to reserve retained earnings from operating profits when the market is booming.

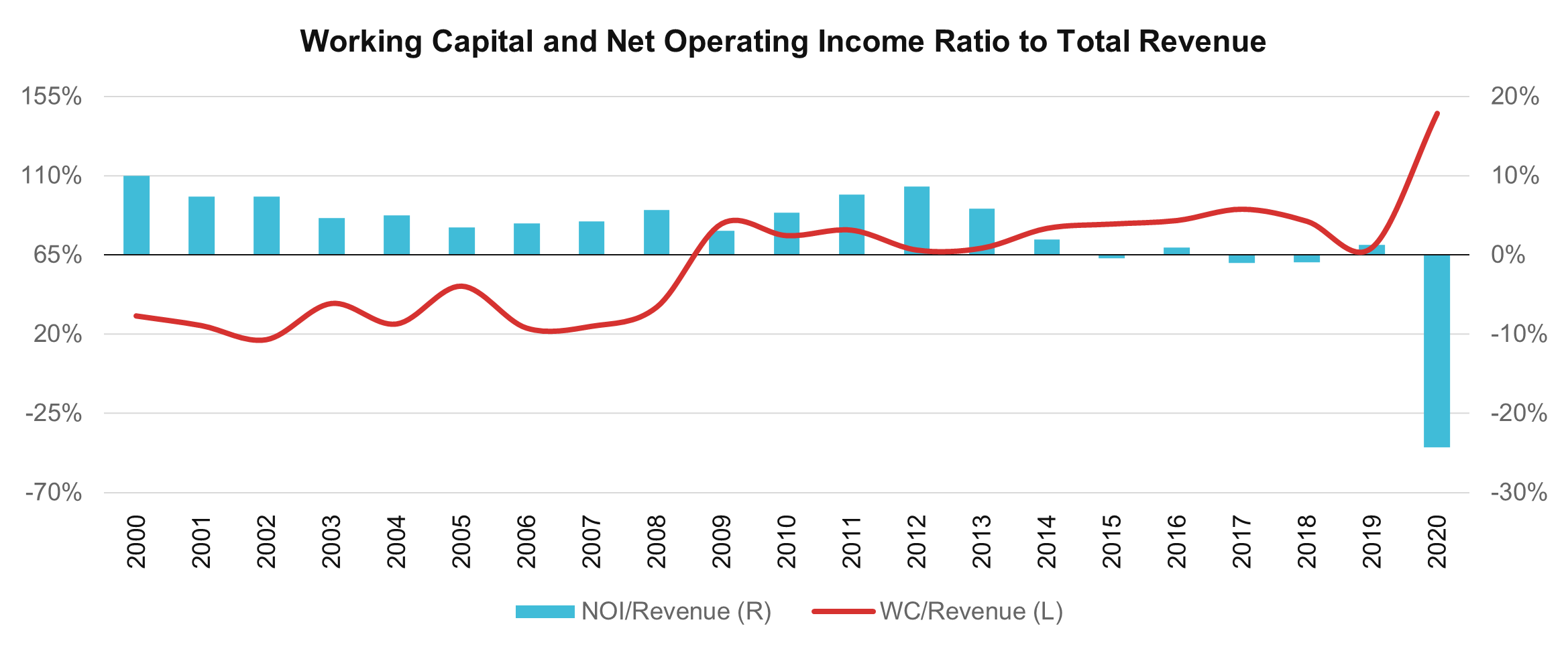

According to the Enterprise Analysis Report by Bank of Korea, the absolute value of working capital in the Korean lodging industry from 2000 to 2020 averaged 64.1% of total sales with the standard deviation was 32.1%. Interestingly, the working capital to total assets ratio began to exceed the long-term average around 2012, when Korean hotel industry was at its peak. This is because the market boom has led to a surge in advanced payments and deposits belonging to current liabilities. As it is common for cancellations to increase with increase of bookings, the burden of working capital increases as well to maintain solvency.

However, the more retained earnings are reserved, the more inefficient the use of capital becomes. This is because it becomes so-called ‘idle’ money, not not paid to shareholders as dividends or reinvested in assets. Therefore, in terms of business stability and growth, it’s important to keep cash and cash equivalents optimal, not more or less than necessary. However, it is not feasible to set a uniform standard for optimizing the working capital applicable across individual properties. This is because the volatility of revenues and the elasticity of expenses vary widely depending on the market where the property is located and the positioning of the property within the market.

When transacting a lodging property, for example a hotel, the subject of the transaction is usually non-current assets and working capital. In other words, the transaction price is agreed upon for the non-current asset, and the transaction is completed when the working capital is subtracted from it. However, as long as business continues during negotiations for transactions, the working capital will continue to change. Therefore, it is common practice to settle the working capital at the pre-determined cut-off time, which is within a certain period of time after the transfer of ownership.

That does not mean that the total investment is reduced by the settled working capital. The settled working capital must be deposited as cash and cash equivalents back in the property. Otherwise, the property will lose even the minimum solvency and will not be able to continue operations. In particular, due to the cyclicality and seasonality inherent in the lodging industry, additional funding is often inevitable because the amount of settlement is not sufficient to cover the working capital, depending on the timing of transaction.

In fact, the settlement of working capital is a routine procedure for most real estate transactions, but it is often considered to be a discount associated with unexpected defects in the property, as the amount is relatively large for loding properties. If this settled working capital is not deposited back into the property and used somewhere else, the property can face a serious circumstance. It can lead to litigation or exercise of lien, triggered by default.

3. Working Capital and Condo Hotels

The constant noise surrounding the condo hotels reveals the situation that the problem of working capital of lodging properties can bring about. Early condo hotel units were sold like apartment units, at the price of development cost with developer profits. In addition, international hotel brands were affiliated as a franchise as if they would solve all the business problems, and the minimum investment return was guaranteed by the developers. However, the franchisos are neither directly involved in operations nor bear the burden of working capital. In addition, as the market began to decline in 2013, more and more developers, who did not reserve a separate working capital account, were unable to pay dividends, let alone the guaranteed return.

After watching this turmoil, latecomers began to recognize the importance of working capital. However, the developers needed to minimize the so-called ‘idle’ money, and on average, an operating company was established with capital equivalent to three months of operating expenses, which leased the units. Guaranteed return was essential for the sale still at this time, but conditions were added to temporarily allow to utilize guaranteed return if the operating company needs additional capital to cover the working capital, in excess of three months’ operating expenses.

In fact, estimating the working capital for a newly developed lodging property is not easy. This is because historical financial data does not exist, and the positioning of the property in the market has not been verified. Nevertheless, three-months’ operating expenses have become a market practice because the initial working capital required by global brands, for mid to low tier segment, is generally at the level of three-months’ operating expenses. Of course, it could be possible for Marriott and Hilton as they operate a large number of hotels with a shared infrastructure.

In most cases, however, three-months’ operating expenses were not sufficient for initial working capital. At a normal sale price, the operating expense for three months is approximately 2.0% of total assets, while the average for the entire lodging industry in Korea from 2000 to 2020 was 14.6%. In other words, it is likely to end up with seven times of three months’ operating expneses. In particular, the owner has no choice but to raise them directly through capital increase or borrowing, if sufficient retained earnings are not expected to accrue in a short period of time.

4. Optimizing the Working Capital

In a market where demand is growing faster than supply, lodging properties with excellent operating cash flows based upon clear positioning are often put in the insolvency by paperprofits circumstance. Experience has shown that most of these situations are caused by insufficient or poorly managed working capital. It is the owner’s responsibility to source the working capital, and it is the operator’s responsibility to efficiently manage it for stable cash flows. Therefore, it is very important to settle the working capital when acquiring existing properties, and to set up the initial working capital when developing new properties. This is because it is the time when the basis is formed to optimize solvency and maintain financial soundness.

As mentioned above, serious problems may arise if working capital is not sufficiently raised, but it is also not desirable to maintain it more than necessary. In other words, balance between working capital and relevant cash and cash equivalents is the key to maintain stability and growth for lodging properties at the same time. The working capital of an individual lodging property is influenced by trends in revenue indicators in the competitive market, its positioning in the market, and its expense elasticity. Of course, the magnitude of influence varies dramatically by market, type and positiong of the property. Anyways, the cash and cash equivalents required as working capital for a lodging property can be optimized as far as there exists a set of historical data for working capital either of the property or of the market.