1. Lodging Business = Real Estates + Services

First of all, non-current assets, including real estate, account for about 75% of the total assets of a lodging business. In other words, investment in the lodging industry can also be viewed as an investment in real estate. However, unlike the general real estate industry, especially the commercial real estate industry, which is produced to generate rental incomes under long-term lease agreements for the period from 1 year to more than 15 years, the lodging industry distributes space products on a ‘daily’ basis. In addition, fixed expenses such as labor costs are higher than that of general commercial real estate sector. In other words, the cash flow generated in the lodging industry demonstrates a volatile pattern close to that of the service industry such as wholesale and retail.

The commercial real estate is an attractive investment sector because it is a medium-risk medium-return asset class properly combining cash flow stability and capital gain maximization. If you focus on the stability of cash flows, bonds may be more attractive products. On the other hand, if you focus on maximizing capital gains, stocks may be more attractive. Although the extreme arbitrage products such as crypto-currency have attracted many people’s attention in recent years, it has been the norm to form a diversified portfolio by allocating assets to optimize the risk and return profile since the Great Depression in the 1920s. The real estate serves as a counter-weight in the asset allocations.

2. Decline in Cash Flows Catches Eyes First

This is because the asset value is not recognized until the asset is actually transacted, while the cash flows are recognized on a real time basis. For example, it is difficult to specifically determine the impact of new office supplies in a market, but if tenants start to escape from existing offices, the impact becomes real. Of course, the frequency of this situation in the office sector is not high, and the solution is not so complicated.

However, such cash flow volatility is ordinary for lodging properties, and solutions can also be complicated depending on the cause of the volatility. In particular, Korean lodging markets are dependent upon much more variables than the United States, parts of Europe, and Japan. First of all, the non-room revenues with higher volatility and higher cost ratio than the room revenues account for majority in the total revenues. In addition, the non-room revenues and the room revenues move on different patterns. Moreover, even the relatively stable room revenues dependent more upon international demands with heavy concentration on low-tier segment, which is more volatile and price-sensitive than domestic demand by nature. Therefore, the volatility is amplified as compared to the other markets. From 2009 to 2019, the average annual growth rate of effective rent for office properties in Seoul was 1.4% with the standard deviation of 3.6%. On the other hand, during the same period, the average annual growth rate of total revenue per available room for hotel properties in Seoul was 0.8% with the standard deviation was 19.2%.

3. Change in Cash Flows Determines the Direction

The asset value of offices and lodging properties, both of which are classified as commercial real estates, depends on the cash flow generated from the assets. For example, a certain discount rate is applied to cash flows, obtained by subtracting operating costs from revenues such as rent, to come up with the asset value. However, a certain level of risk premium is added to the discount rate for lodging properties as compared to that for offices. In other words, when the same cash flow is generated from an office and a hotel, the asset value of the hotel is lower than that of the office.

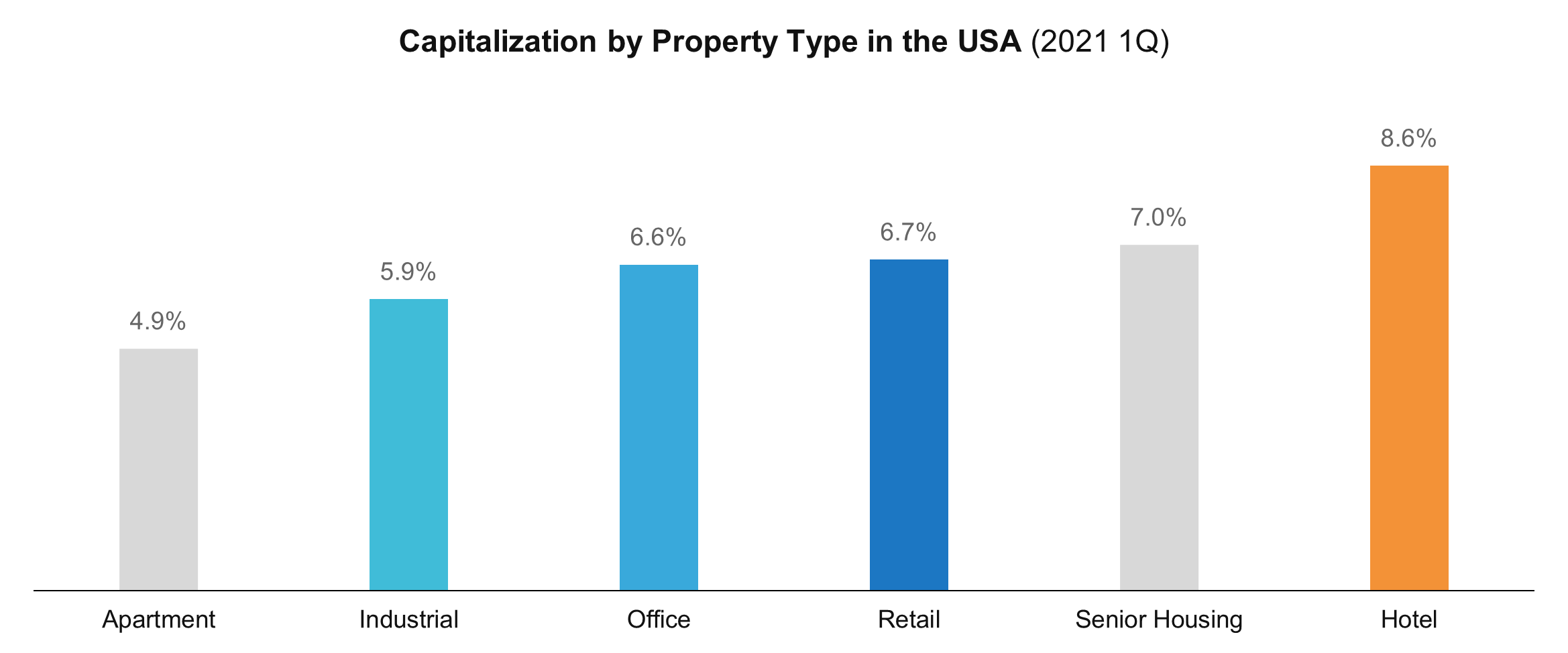

In the first quarter of 2021, the risk premium for hotels, as compared to the offices, in the United States was approximately 2.0%. The capitalization rate, the most easily used discount rate for evaluating the asset value of commercial real estate, for the office was 6.6%, while it was 8.6% for the hotel. In other words, if offices and hotels generate the same net operating profit of KRW 10.0 billion a year, the office’s asset value will be KRW 10.0 billion / 6.6% = KRW 151.5 billion, and the hotel’s asset value will be KRW 10.0 billion / 8.6% = KRW 116.3 billion. The 2.0% risk premium is discounting the hotel’s asset value by KRW 35.2 billion.

4. Cash Flows Volatility and Asset Value

There is a more realistic reason for this than psychological anxiety. Large-scale commercial real estate is often purchased not only with equity capital but also with debt. The cost of debt, an interest rate, is generally constant or varies insignificantly if it varies. The problem arises when the cash flow generated from the asset is less than the interest to be paid, which is called a default. If the default is prolonged, ownership can be transferred, so a certain level of solvency must be maintained at all times regardless of cash flow volatility. And the greater the volatility of cash flows is, the greater the likelihood of default is, resulting in the stricter requirements for solvency.

Unlike offices where cash flow volatility is not high, the lodging properties often struggle with meeting the requirements for solvency. The lodging business is distributing not just the stand-alone space products, but the products combining spaces and services, so operating costs such as cost-of-goods and labor costs are burdensome. In other words, before paying the interest, problems may arise first in the ability to pay such operating costs. Working capital refers to cash and cash equivalents utilized to manage these solvency. To put it simply, you have a certain amount of extra cash so that you can pay the costs before you collect revenues. Of course, as revenues decrease, the burden on working capital increases. And if you don’t have enough working capital, you should be able to raise additional funds elsewhere.

Lobin Dashboard provides not only revenues and operating costs data for lodging properties in Korea, but also asset value and working capital trends data by region and property type, for the period from 2005 to 2021. In addition, it also provides relevant macroeconomic indicators together, which allows not only to capture the pattern of volatility but also to diagnose the causes.