According to the Compendium of Tourism Statistics published in 2020 by UNWTO, total value created in lodging industry of Korea was 5% of the USA’s and 16% of Japan’s, as of 2017. The reason for using 2017 figures is because there are missing data points in these countries for recent years. Anyways, given the difference in size of overall economy, it may be helpful to look at it by unit value than lump sum amount, in evaluating productivity of lodging properties. Going back to the statistics, the monetary output per room was $12 thousand in Korea, while it was $40 thousand in the USA and $46 thousand in Japan. There could be several reasons for such a low productivity in lodging industry of Korea.

1. Black Market

According to the UNWTO statistics, 5.41 million rooms were supplied in the USA in 2017, while it was 1.46 million in Japan and 0.87 million in Korea. Among them, lodging properties in the USA sold 66% of the inventory, while those in Japan and Korea sold 61% of the inventories. Based in this, the average monetary output generated per each room night sold is calculated as $165 in the USA, $209 in Japan and $56 in Korea. Please note that the figures include revenues generated from room facilities as well as from non-room amenities.

According to Korea Hotel Association(“KHA” hereinafter), approximately 1,600 hotels supplied 140 thousand rooms in 2017, among which 61% of the inventory was sold with the average monetary output of $171 per each room night sold. In other words, each hotel room generated $38 thousand revenues per year on average. To be clear, hotels in this statistics include star-rated tourist hotels as well as unrated family hotels, traditional hotels, hostels and small hotels.

The first thing to pay attention here is the difference in supply volume between UNWTO statistics and KHA statistics. UNWTO says it was 870 thousand rooms while KHA says it was 140 thousand. It is a big discrepancy but could be explained by the difference in definition of “hotel”. In the USA and Japan, hotels include most commercial lodging properties, while it includes only those registered pursuant to Tourism Promotion Act in Korea. It means that, in Korea, lodging properties having nothing to do with Tourism Promotion Act, such as motels and serviced apartments, are not captured in the statistics. The statistics captures only 26% of total inventory by room count.

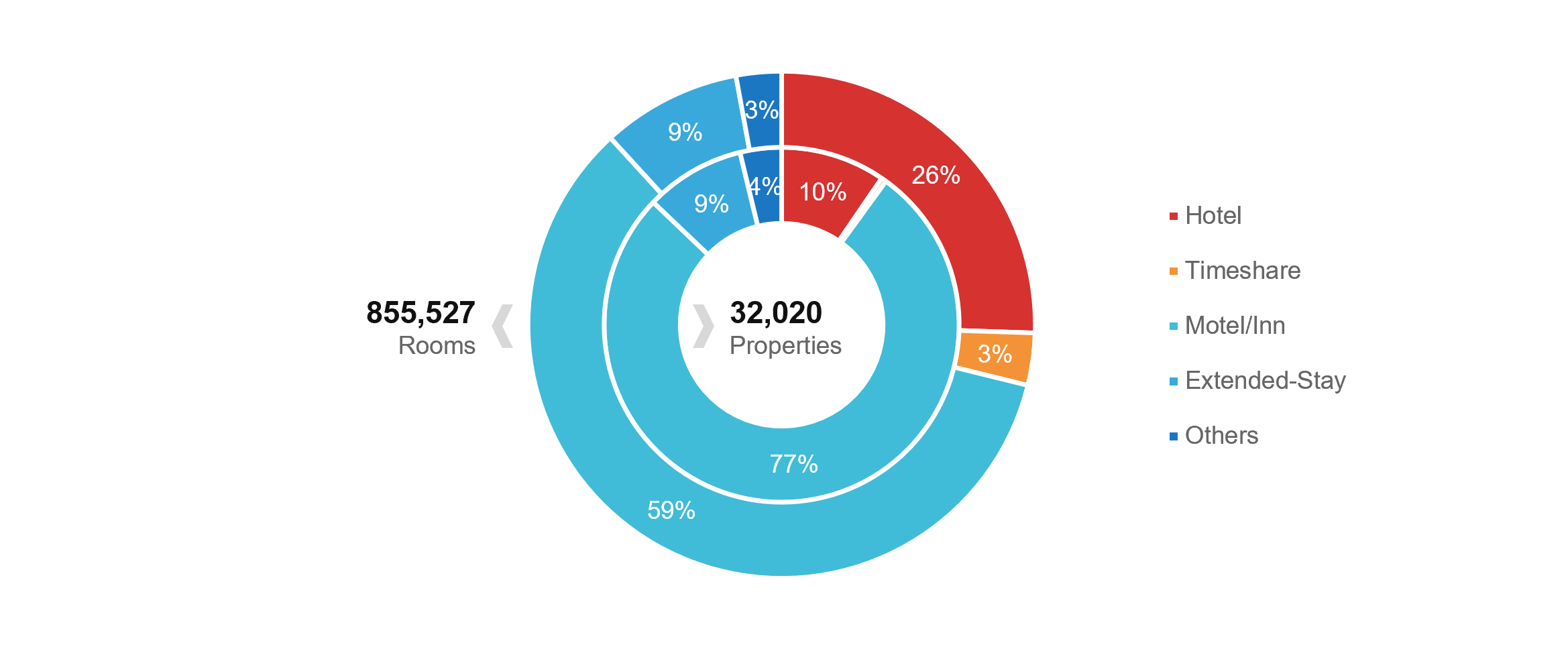

Based upon the data from local governments in Korea, it is estimated that approximately 3,000 hotels provided 218 thousand rooms, 148 timeshare properties provided 28 thousand rooms, 24,700 motels provided 508 thousand rooms, 2,900 serviced apartments provided 76 thousand rooms and other lodging properties such as youth training centers provided 25 thousand rooms in 2017. In other words, 31 thousand lodging properties supplied 835 thousand rooms in 2017, meaning that the inventory captured in KHA statistics captures only 66% of all hotel rooms and 17% of all commercial lodging rooms. On the other hand, motels, not captured in the statistics, account for 59% of the inventory by room count. By the number of properties, hotels captured in the statistics account for 5% of total inventory, while motels account for 77%. There is no public information about operating performance for motels either for free or for a charge.

The biggest problem with this status is that there is no way to properly understand and evaluate the supply and demand dynamics in Korean lodging market. Moreover, invisibility over the lodging market allowed the majority to stay away from regulations as they want.

This problem incurred an unexpected circumstance. In 2012, when the Korean Wave was at its peak, the government of Korea enforced the Special Act on the Expansion of Tourist Accommodation Facilities. Back then, tourist arrivals reached 10 million for the first time in history, and hotels in Seoul ran at 80% occupancy on average. It is somewhat understandable that lodging properties may have looked under supplied. The special act granted new hotel development projects additional building capacities. It was effective in booming up hotel developments. As a result, the number of hotel rooms doubled to 158 thousand by 2019 from 82 thousand in 2012.

However, Japanese tourists, who have been the main driver of hotel market prosperity in Korea until 2012, were replaced by Chinese tourists in 2013. Although the demand base still seemed to grow in numbers, the price dropped significantly not because of growing competitions but because of demand base shifting downward in price. In addition, the lower priced Chinese tourists brought the “underground” market – motels – “overground”. In fact, international visitors do not have to stay only at hotels, as some motels actually offered better values for money than hotels. They were just not visible to most international tourists at first. Unfortunately, it was not the end of the story. The market was traumatized even more when Chinese tourists disappeared due to MERS followed by THAAD strain.

As illustrated above, majority of lodging market in Korea is not captured in public statistics and, therefore, not visible. So to speak, the “black market” is steering the entire market. This circumstance has been keeping lodging operators and investors, whether global or local, from properly evaluating and managing lodging market risks in Korea.

2. Leisure Demand

As one of many travel products, it is common that lodging properties are occasionally packaged with leisure activities and/or destinations. For example, proximity to well-known tourist attractions or association with local festivals enable hotels to sell at premium. Given that travel is not an everyday routine for most people, an extraordinary experience could be the driver for a decision, especially for leisure travelers.

By the way, is the leisure demand actually taking up a giant share in generating profit for lodging properties? It may be clear that hotels in Jeju are reliant heavily on leisure demand. Hawaii is an equivalent in the USA and so is Okinawa in Japan, which are generally referred as resort destinations. The most prominent characteristic of such resort destinations as a lodging market is that majority of demand is concentrated in a specific period of time in a year. Such period is typically referred as a peak season, which is typically about three to four months. Owners and operators of lodging properties in resort destinations have to make sure they achieve the annual target during such period. Otherwise, the property is likely to be in a financial trouble. The stronger the seasonality is in a market, the riskier the market is both for operation and investment. In addition, leisure travelers tend to look for new places than to revisit a specific place, which makes it more challenging for resort destinations to maintain a stable demand base, amplifying the risks even more.

Traditionally, the most lucrative segment has been the business demand. Business travelers are typically stable throughout the year as they repeatedly visit a specific location for business purposes, and not as price-sensitive as leisure travelers. In other words, it is a less risky demand base for owners and operators. Therefore, the performance of a lodging property other than in a resort destination is dependent on how successful it is in attracting business travelers. Also, in the entire lodging market, the share of resort destinations is quite limited and, therefore, most lodging markets pursue business demand. According to STR, resort destinations account for 13% out of 5 million rooms in the USA, and it is 8% in Korea.

Although lodging markets are frequently associated with leisure demand, the backbone is business demand. Of course, with consumer lifestyles changing so dramatically, there’s no guarantee that this will be the case in the future, but it’s still a fact that holds true regardless of country.1

3. International Demand

In Korea, whenever media write about lodging industry or market, they include statistics about tourist arrivals. It indicates how important the international demand is in Korean lodging market. International visitors reached 10 million in 2012 for the first time in history, and reached its peak at 17 million in 2016. International demand has accounted for 70% of hotel demand in Seoul, while the share decreased to 63% in 2017, excluding motels and serviced apartments. However, international demand accounted for 44% of hotel demand in the entire Korea. Taking into consideration of the fact that 37% of hotel rooms were concentrated in Seoul in 2017, the other markets relied heavily on domestic demand. It was even more so for non-hotel lodging properties, such as motels and serviced apartments.

It has been a long love story for owners and operators to make eyes at international demand, as they typically accept higher prices. Korea is just not so much different in many markets where domestic demand base is not thick enough. Apparently, it is a great opportunity which owners and operators cannot afford to miss in making the most cash flows out of limited resources. However, there is a downside with them, which is the volatile nature unless balanced carefully. International demand is impacted by a lot more factors than domestic demand, making it much more volatile, while the revisit rate is relatively low.

Let’s look into factors impacting international demand in Korea. Until 2012 when Korea lodging market was at its peak, Japanese tourists drove the unprecedented growth, driven by Korean Wave and their strong economy backed by a weak yen. However, it changed dramatically in 2013. A strong yen brought down the economy, keeping them home, while Chinese tourists took the stage instead. Since then, street signages in Myeongdong have been replaced with Chinese characters. At the same time, performance of lodging properties in Seoul started to decline. Chinese tourists visited Korea through travel packages, contrary to free individual Japanese tourists. Most travel packages were designed to promote shopping and the budget allocated for accommodation was tight. It brought the prices down over the entire market, but there was not any other option left for owners and operators. Moreover, when they revisited Korea, they did not hesitate to to stay at motels. On top of it, the fatal blow was MERS in 2015 and THAAD strain in 2017, which swept out Chinese tourists. Then, the lodging market collapsed as even the low margin demand has gone away.

Generally, international demand is perceived as the best way to realize the upside potential, but it does not seem to be a stable demand base. Actually, most stable lodging markets rely on domestic demand. For example, according to NYC & Company, domestic demand account for approximately 75% of overall lodging demand in New York City, and it is more than 80% in Tokyo according to JTB. On the other hand, there are stable markets reliant upon international demand, such as Hong Kong and Singapore. The difference between them and Korea is that they were able to build up and maintain a strong demand base with business travelers than with leisure travelers, crossing borders.

4. Cost Structure

With the entire territory falling under a one-day living zone due to the sophisticated transportation network across the country, lodging is not a critical component for most domestic travelers in Korea. Instead, domestic customers associate lodging properties more with fine dining options, including high-quality buffet. Comfortable guestrooms, together with leisure activity options, matter more for those travelling with family for vacation. As such, there is a common misunderstanding that lodging properties offering variety of high-quality dining options are more profitable.

In short, this circumstance is keeping lodging properties from building up a sustainable cost structure. Direct expense for room operation is approximately 30% of rooms revenue, while it is more than 70% for food and beverage operation. It is a common practice across the world, which was originated in the USA. Korea is not an exception either, as modern hotel prototype was imported from the USA through Japan. Motels are not different either as they are a derivative of modern hotel products, which are highly standardized across the world. A unique characteristic of Korean lodging properties is that they tend to generate more revenues from non-room operations.

For example, 5-star hotels generate 40% of revenues from room operation and 60% from non-room operation. On the other hand, those in the USA generate 60% from room operation and 40% from non-room operation. Let’s say the total revenue at a 5-star hotel is 100. One in Korea generates an operating profit of 28 from room operation and 18 from non-room operation, summing up to a direct operating profit of 46. However, one in the USA generates 43 from room operation and 12 from non-room operation, summing up to 54, which is 17% higher than that in Korea. Let’s move on one step further. If the undistributed expense is 20% of total revenue, the final operating profit is 26 for the Korean hotel and 34 for the USA hotel. In both markets, majority of the operating profit comes from room operation, assuming that the operating practice is standardized for them.

In Korea, food and beverage business is clearly an important source of cash flows for lodging properties, as room demand is not expected to be stable. At the same time, the focus on food and beverage operation restricts profitability of lodging business as a whole, as the operating margin of food and beverage operation is much tighter than room operation. Nevertheless, banquet seems like the best of a bad bunch, followed by beverage and food in order.

5. Asset Value

A lodging property is a commercial property with rarity value. There are not as many of lodging properties as the other commercial properties, such as office and retail, and transactions are much more scarce due to the size of a property. Also, the valuation of a lodging property is a more challenging practice in that there are not enough visibility over high volatility and low profitability, which could enable investors to fix the problems.

The value of a commercial property is determined by cash flows it is and may be generating. On the other hand, valuation of a residential property is much easier as it would be mostly of calculating the change in transaction prices, based upon supply and demand dynamics. Moreover, in Korea, Jeonse, a rental practice of deposit-only without monthly rent, is a prevailing in housing rental market, which makes a residential property investment more of an arbitrage. Therefore, the value of a residential property cannot be subject to on-going cash flows. Only commercial properties such as offices, retails and lodging properties can be valuated by on-going cash flows here.

The cash flow of a lodging property is probably the most complicated one in commercial property sector, as it is more like a daily lease with variable prices while offices and retails are leased by five to ten year terms generally at fixed rents. It is even more so in Korea given the amplified volatility in cash flow due to the demand base located out of the border. This does not mean that estimation is impossible, as the market has a repetitive cyclical and seasonal pattern in revenue indicators, just like any other countries. Only the amplitude of the pattern is wider than the others, such as the USA and Japan. Another advantage of Korean is that it provides a clear visibility over the capital market and the financial policies, which enables to control the capitalization rate within a predictable range.