Consulting > Consulting Approach

Consulting Approach

Concerns for insolvency and shorter life cycles of lodging establishments are growing, as establishment types diversify and establishments downsize. The best way for lodging property owners and operators to fully control their establishment’s life cycle is to strike a balance between stability and agility. Lobin provides consulting services to help achieve it.

1. Economies of Speed

In the lodging industry, economies of scale, based on the mass production and distribution of standardized products, have been the most effective means of gaining a competitive edge. However, as establishment types diversify and establishments downsize, the economies of speed is gaining attentions.

Field

2005

2023

CAGR

Establishment Type

13

23

3.22%

Establishments

33,388

63,216

3.61%

Rooms

754,433

979,349

1.46%

Average Rooms

23

15

-2.08%

* Data Source: Lobin's Lodging Database (Updated July 27, 2024)

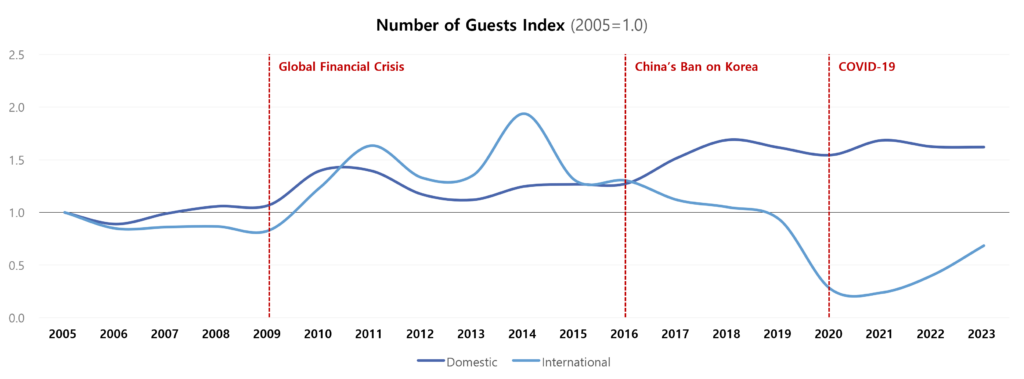

2. Increase of Volatility

Meanwhile, with the diversification of establishment types, demand is spreading out, leading to increased volatility in demand. However, due to the downsizing of establishments, their ability to respond to volatility has weakened, increasing concerns about insolvency and shorter life cycles.

3. Principles of Consulting

Lobin's consulting services aim to minimize the risk of involuntary closure and help property owners and operators fully control the life cycle of their establishments. Lobin's consulting services are provided according to the following principles:

- We aim to build a value chain optimized for the characteristics of products. We set specific goals for a lodging establishment by accurately diagnosing its positioning in the competitive environment, and establish operation management, financial management, and asset management systems optimized for the goals.

- We aim to strengthen the ability to respond to short and long term volatility in the lodging market. In the process of building operation, financial, and asset management systems, we ensure that agility is secured for flexible responses to the dynamically changing competitive environment.

- We aim for maximum effectiveness with minimal time and cost. The consulting process is divided into itemized consulting, phased consulting, and overall workout, and is planned and executed in the most optimal manner for the situation of the lodging establishment and the client.

- We provide consulting services with a decision-making system based on client's confidence. During the process of itemized and phased consulting, we provide data-driven decision-making systems so that clients can make decisions with confidence.

4. Scope of Consulting

Lobin's consulting services aim to help lodging establishments strike a balance between economies of speed and economies of scale. In other words, we help secure both financial stability and agility to ensure full control over the life cycle of the establishment, through following services:

Category

Field

Item

Goal

Operations Management

Enhance Productivity

Optimize Distribution Channel, Marketing Mix, Pricing Policy

Increase Revenues

Enhance Efficiency

Optimize Staffing, Purchasing Channel, Operating Standards

Reduce Expenses

Financial Management

Enhance Expandability

Optimize Asset Mix, Credit Score, Financing Channel

Smooth Financing

Secure Stability

Optimize Working Capital, Current Ratio, Cash Management

Maintain Solvency

Asset Management

Enhance Functionality

Optimize Facility Mix, Circulations, Utility Capacity

Extend Life Cycle

Enhance Differentiation

Demand Restructuring, Remodeling, Store Addition

Secure Competitiveness

Overall Workout

Short-term Measures

Financial Restructuring, Change Establishment Type, Rebranding

Effective Positioning

Long-term Measures

Optimize Owning & Operating Structure, Liquidate Assets

Efficient Value Chain