Consulting Approach

1. Risks of the Lodging Business

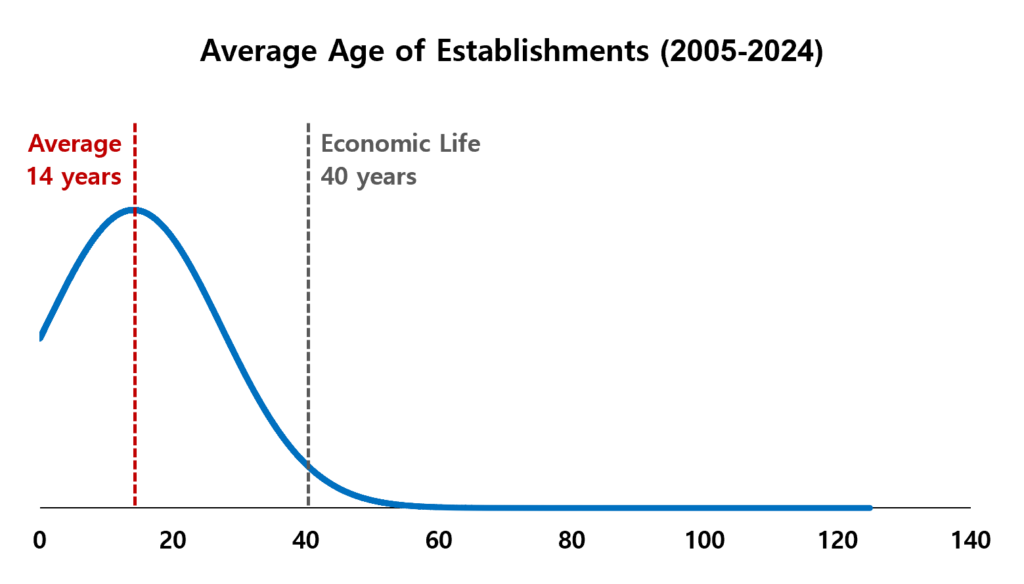

The risk of the lodging business in Korea can be described from its short lifespan. The lodging business is based on assets with an economic life of up to 40 years, and a short lifespan indicates that the asset has not been utilized effectively.

During 2005–2024, the average lifespan of the lodging business in Korea was 14 years, which is only 35% of its economic life. In other words, any investment or lending to the lodging business must be redeemable in 14 years, and the asset must be capable of alternative use thereafter.

2. Risk Management in the Lodging Business

① Maintaining Product Competitiveness

The average room count per lodging establishment in Korea declined from 20.1 rooms in 2009 to 12.7 rooms in 2024, representing an average annual decrease of 3.0%. Over the same period, the average age decreased from 15.2 years in 2009 to 13.0 years in 2024, an average annual decline of 1.0%. In other words, lodging establishments have become increasingly small-scale, while their lifespans have shortened.

Because small-scale lodging establishments inevitably have limitation in product mix, they face constraints in absorbing variety of lodging demand, whether short-term or long-term, individual or family-based. This represents a clear weakness in responding to dynamic market changes.

Rather than encouraging small-scale lodging establishments with limited product mix to pursue excessive investment to expand their size, Lobin Co. guides them to diversify demand through flexible operations. Through the Lobin database, the composition and characteristics of demand by lodging market are precisely identified.

② Maintaining Operational Stability

After the enforcement of the Tourist Accommodation Facilities Act in 2012, supply began to increase from 2015 onward, and the closure rate of lodging establishments in Korea started to rise. In 2019, when small-scale lodging establishments surged, closure rates accelerated upward further. The closure rate is still at a high level, which peaked in 2021 due to the impact of COVID-19.

In an increasingly uncertain market environment, fluctuations in revenue are amplified in the lodging business. In particular, for small-scale lodging establishments that are more vulnerable to revenue volatility, maintaining appropriate levels of cost flexibility and financial soundness is critically important.

Lobin Co. secures cost elasticity that enables effective responses not only during market upturns but also during downturns by optimizing the composition of fixed and variable costs. Furthermore, cost flexibility is monitored regularly to ensure its sustainability.

③ Maintaining Financial Soundness

The Altman Z-Score is an indicator used to measure a company’s bankruptcy risk and is one of the core algorithms utilized by credit rating agencies. In the service sector, a Z-Score below 1.23 is considered indicative of high bankruptcy risk. The bankruptcy risk of the lodging business in Korea is therefore very high.

For service industries such as the lodging business, the Altman Z-Score is calculated based on liquidity, cumulative profitability, productivity, and financial structure. A smaller asset size and stronger cash liquidity tend to increase the Z-Score. In such cases, financing from financial institutions may become relatively smoother.

Lobin Co. derives a financial structure minimizing asset burden while maximizing cash liquidity, and optimizes it according to the conditions of each operator. In addition, financial soundness is monitored regularly to ensure its sustainability.