1. Real Estate Never Fails

At the root of the problem, there is the desire to invest in good assets and earn a stable return. Actually, there’s nothing wrong with it. Korea is struggling with aftereffects of rapid growth, like other mature markets, after a dynamic ride from one of the poorest countries to the 12th largest economy in the world. Companies that need to survive in a competitive environment are struggling to cut costs and reduce labors. Meanwhile, as the concept of a lifetime job has disappeared and the future has become uncertain in such environment, people are flocking to asset markets such as stocks, bonds, real estate, and more recently cryptocurrency in search of sources of income that do not directly involve labor. No one can challenge against it, as it is their right to make the most out of permitted freedom to protect their own interests in a cold-blooded capitalism society.

Traditionally, real estate has been the most sought-after asset class for Koreans, especially housing. Thanks to the rapidly growing economy, people’s living standards have improved steeply, but quality housing has not been supplied sufficiently at the pace. One of the reasons was the fact that housing supply has been controlled entirely by the government, meaning that the pace of supply growth has never caught up with that of demand growth. In other words, there have not been enough supply of quality housing, and the increase in house prices has continuously expedited over time. This is where the myth of never-failing-real-estate began, and real estate actually has been the most stable and profitable asset class.

The problem arose out of the inefficient market, meaning the asymmetry of market information. Those who obtained information on the development of new housing sites before others were able to accumulate wealth through real estate, but for those who did not, the soaring lease and monthly rent became increasingly burdensome. In other words, the controlled supply of quality housing actually worked as the cause of bipolarization of wealth, instead of improving living environment of the middle-class. This relative deprivation has spread the perception that real estate is a tool of exploitation rather than a stable asset. Moreover, real estate has been utilized as an easy way to boost economy or a target for regulation, depending on the government’s administrative stance, resulting in an unstable real estate market.

2. Betray of Hotel Market

In 2009, when the global economy collapsed due to the financial crisis from the U.S., the impact was relatively small in Korea. One of the biggest drivers was the Korean Wave that hit all over Asia. Korean soap operas and K-pop have been sold throughout Asia, and the number of tourists visiting Korea has increased rapidly. In particular, it was the Japanese who led this travel boom at the forefront, equipped with enhanced consumption power based upon weak Yen. Apparently, the hotels in Korea experienced an unprecedented boom then.

At that time, it was difficult to find empty hotel rooms throughout the year in Myeong-dong, which was popular among Japanese travelers. Then, the government, inspired by the circumstance, began to be deeply involved in supply, just like the housing market. In 2012, the Special Act on the Expansion of Tourism Accommodation Facilities took effect and led to a rapid increase in supply of hotels. Those who had empty land or wanted to demolish and rebuild existing buildings started building hotels. The special act allowed additional density for hotel developments, significantly increasing the value of a land with a hotel. Anyways, during this time, newly licensed, high-density hotels began construction with the goal of opening by 2015.

However, when the Yen soared in 2013, the Japanese stopped coming, as if they never had. Hotels that had expanded their facilities and added staff in a seemingly never-ending boom had to face embarrassment. Fortunately, the Chinese travelers filled the vacancy of the Japanese. However, the Chinese were different from the Japanese. Unlike Japanese who preferred individual travel, they were mostly on group travel, and the budget allocated for accommodation was extremely tight. More than four people stayed in one room, and they started looking for hotels or even motels in the outer area in search of cheaper accommodations.

Despite this change of market environment, new hotels began to open one by one in 2015. But the markets they faced were completely different from their initial expectations, and they had to compete fiercely to absorb as much low-priced demand as possible. The counter punches that flew in here were the MERS in 2015 and the THAAD strain in 2016. This is because even the Chinese, who had been forcibly supporting the brutal lodging market, stopped visiting. The newly opened hotels are at a life-or-death crossroads, with no time to build up their strength.

3. Dark Side of Condo Hotels

While the problems did not spread out of those who built hotels on their own land, the problems have spread out of condo hotels to the extreme. Many people, who were unaware of the value chain of lodging industry and the volatility of the lodging market, were misled by the phrase “guaranteed returns,” and were sold and plunged into an exponentially growing financial trouble. In fact, condo hotels in Korea had fundamental problems by nature. There was nothing strange about the problems turning to bombs and bursting at the end of the day. The real catalyst was the fact that most of the developers were not aware of the problem in the first place, and they were not able to deliver risks properly to individual unit purchasers.

The first problem is that the developers without experience in lodging industry approached the condo hotel development project in a similar way to the housing development project. In the case of housing development projects, the risks borne by the developer go away as soon as the sale is completed. In other words, the only risk is how quickly and cheaply they complete the development itself, without needs for worrying about post-completion circumstances. However, in the case of hotels, how they operate after opening will have a greater impact on asset value. This is because the value of a commercial property is determined by the cash flows generated from the property. Furthermore, unlike housing, lodging properties do not generate cash flows immediately upon completion, and it takes from one year up to five years to stabilize cash flows after opening. Until then, they typically run at loss, and owners are put in a situation to make up for losses by procuring additional capital in the form of a working capital at the beginning of the opening. However, condo hotels, which were carried out in a similar way to the housing development project, often did not take into account of this working capital. It was like the individual unit purchasers paid prices including working capital, while only the real estates were delivered to them.

The second problem is that the precise allocation of value by individual unit was not a feasible practice unless the cash flows are precisely allocated by individual units. A lodging property, including guestrooms and amenities, generates cash flows as a single business, and it is not easy to differentiate contribution of each unit, which is not an issue for housing units. Some rooms sell more at higher prices than others, while others do not. It is even more complicated to allocate operating expenses. Also, it is practically not feasible to know how much labor and materials were required to operate and how much of capital expenditures each unit needs when wear-and-tear is different, before actually seeing it. So, someone might have purchased a unit at a lower price than the actual value, and vice versa. In other words, the difference in asset value among units, based on cash flows, is hard to be reflected at the time of sale. This amplifies the problem in the post-opening operation process. For example, an owner of a popular unit may not be satisfied with receiving the same dividends as an owner of a unpopular unit. Also, an owner of an unpopular unit may not be satisfied with paying the same cost of repair and maintenance as an owner of a popular unit.

The third problem is that many of the developers, who became aware of this problem, exploited it to maximize their profits rather than optimizing their ownership and operational structure for the purchasers. After watching the failure of early-stage condo hotels, the developers raised the sale price in consideration of the initial working capital and introduced a “guaranteed return” scheme. In fact, the returns were paid out of the reserved initial working capital, which should have been used to make up for the losses during the stabilization period. It’s like the money I put in someone else’s trust comes back as if it’s a return. However, they washed their hands, passing the real responsibility over to the unit owners, once the initial working capital was exhausted. Then, the backstabbed buyers had to sue the operating company, which had become a ghost company, to get the money back.

4. Bright Side of Condo Hotels

A condo hotel is not technically a hotel in the context of Korean regulations. The Enforcement Ordinance of the Building Act classifies lodging properties into tourism accommodations, general and residence accommodations, and multi-living facilities, while the Tourism Promotion Act classifies tourism accommodations into hotels and timeshares. However, the Tourism Promotion Act allows a membership scheme for hotels while it still does not allow to be condomized. So-called condo hotels are actually falling under the category of general and residence accommodations in Korea pursuant to under the Public Sanitation Act. In most cases, it is registered as a residence accommodation, similar to the officetel available as an accommodation.

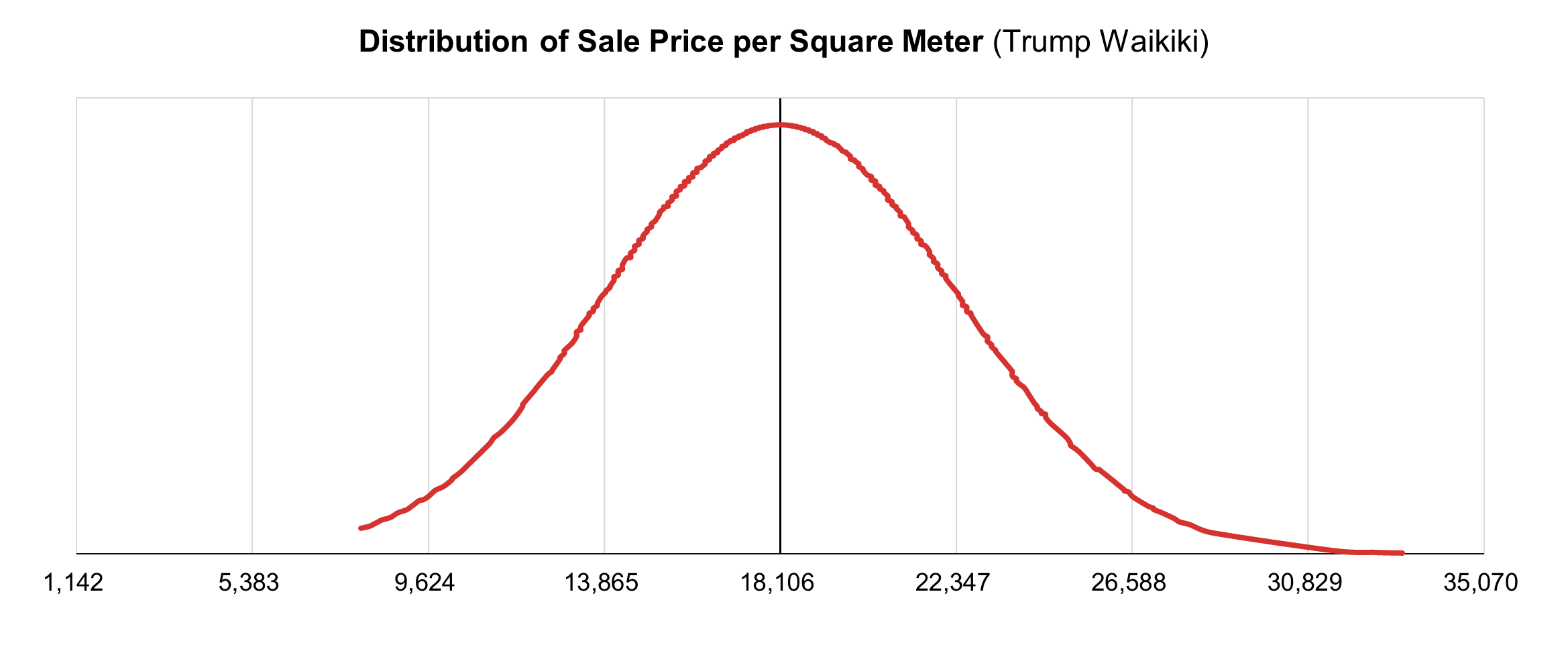

In the U.S., condo hotels were boomed mostly in vacation spots like Hawaii and Miami. Trump Hotel in A La Moana or Fontainebleau Hotel in Miami Beach are some of the most popular condo hotels. It is true that condo hotels attracted many people as a source of stable income, in the early stage. However, due to the highly volatile cash flows, the yield has never been stable, and there were also frequent cases where additional working capital had to be paid. More importantly, condo hotels attached with famous brands regularly incurred capital expenditures for renovations, beyond the routine capital expenditures, which should have been pulled from unit owners. This made may unit owners convert their units into residences. As a result, many condo hotels have disappeared because the number of rooms in many condo hotels has not maintained stable.

The remaining condo hotels in the U.S. are based on motivation to have a second home only at the purchase price without additional on-going costs, rather than to have a stable income. In other words, the unit owners does not need to worry about operating expenses other than the purchase price, as they will be paid by guests staying at the property when the owner does not use. For this reason, condo hotels in Miami are often owned by wealthy people from the northeastern U.S. or Canada, and condo hotels in Hawaii are often owned by wealthy people from California or Japan.

5. Liquidation of Lodging Properties

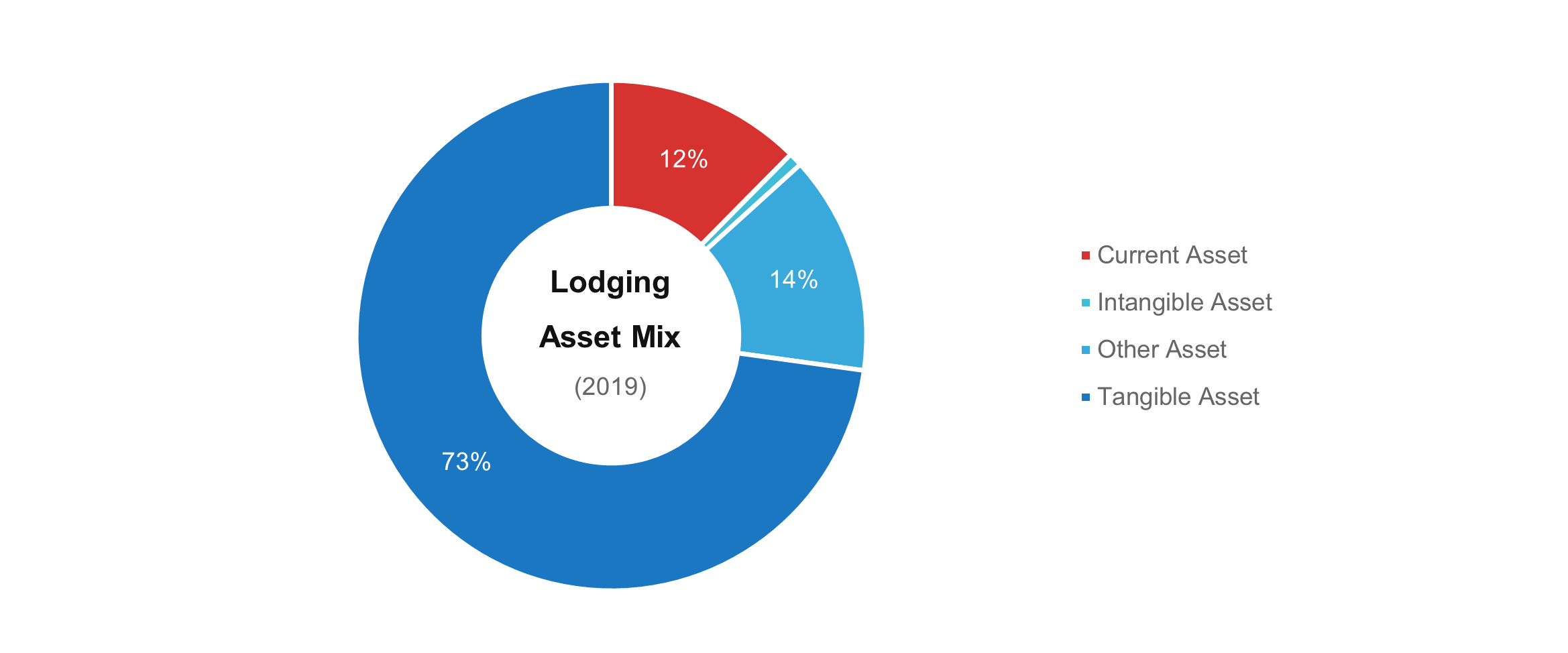

A lodging property is not quite designed for unit ownership. Although the role of non-room amenities has recently been gaining attention, most of the cash flows generated at lodging properties are generated through rooms. And the rooms are products based on the mass production and mass consumption of standardized products. In other words, economies of scale are bound to exert power. In order to effectively manage cash flow in the lodging market where the peak and off-season exists, both of expensive rooms and cheap rooms are needed at the same time. Also, fixed costs, which are the biggest burden on operating expenses, should be broken up as much as possible. In other words, the entire property should work as a business unit, rather than individual units to work as independent business units.

Consequently, considering the stability of the operation, it would be more reasonable to liquidate interests in the property as a single asset rather than splitting ownership by individual unit. It’s a concept similar to so-called REITs, but there are limitations that lodging properties don’t exactly fit into REITs scheme either. REITs require most of the cash flows generated to be paid to investors as dividends. However, lodging properties need to retain certain level of cash as working capital to manage market volatility, or as capital expenditure reserves for future renovations, whenever there is a surplus in profits.

It seems that the starting point for solving the problem of the already troubled condo hotels is to consolidate the ownership interests to get it ready for liquidation as a stand-alone asset. It is like putting together the torn down pieces of a dollar bill to bring back the value for trade. In this process, it may also be helpful to separate the operating entity from the asset holding entity so that they can be liquidated separately. Of course, in order for the restructuring to proceed in this direction, the pending litigations regarding the condo hotels will need to be settled in some way or another first.